Tabby Says No New Minimum As Some Online UAE Stores Set AED300 Order Threshold

Leading buy-now-pay-later (BNPL) provider Tabby has revealed that customers in the UAE do not have a new minimum order value, except when shopping on certain partner brand websites.

“Tabby does not have a new minimum threshold for customers. In rare cases partner brands may impose a minimum basket size,” Tabby clarified to Arabian Business in a statement.

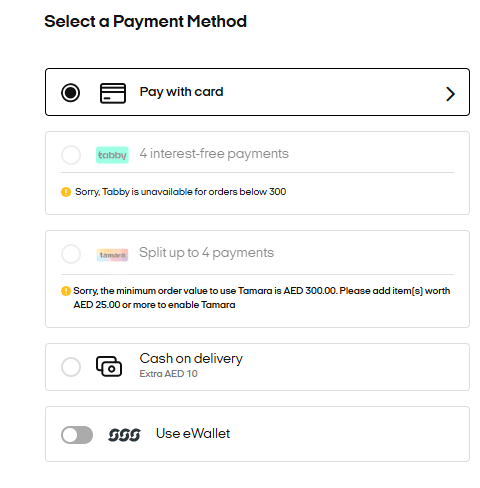

Arabian Business first noticed an AED300 cap on orders on the ‘payments’ page of Sun & Sand Sports’ online shopping website.

Previously, customers could split payments for purchases of lower values, but the new threshold indicates a strategic repositioning of these services towards larger transactions.

In December 2024, Tabby removed its late fees on its Pay in 4 payments in Saudi Arabia. This change aligns with Shariah principles and follows a Fatwa issued by the Council of Senior Scholars in Saudi Arabia.

The initiative reflects Tabby’s commitment to providing transparent and Shariah-compliant Buy Now, Pay Later (BNPL) services. Tabby serves over 10 million users, helping them manage their spending and finances.

More than 30,000 brands and businesses, including SHEIN, Amazon, Adidas, IKEA, H&M, Samsung, and Noon, use Tabby to offer flexible payments online and in stores. Operating in Saudi Arabia, the UAE, and Kuwait, Tabby is valued at $1.5 billion, backed by investors such as Wellington Management, STV, Mubadala Investment Capital, and PayPal Ventures.

Emicool Secures First-ever Green Financing To Boost Sustainable Growth

The liquidity generated will be strategically deployed to accelerate the company’s district cooling projects across t... Read more

UAEs Ruya Becomes First Global Islamic Bank To Offer Shariah-compliant Crypto Trading

Digital Islamic bank ruya teams up with Fuze to offer secure, ethical crypto investments aligned with Islamic financial... Read more

Startups In Abu Dhabis Hub71 Secured $2.17bn In Funding Last Year

Hub71 startups in Abu Dhabi saw massive increase in funding in 2024 as innovation economy thrives Read more

UAE Fintech Pay10 First To Launch On Central Banks Open Finance Framework

The company has acknowledged the Central Bank of the UAE's crucial role in facilitating a responsible and secure rollou... Read more

PayPal Expands In MEA Region With Its Newly Launched Hub In Dubai

Will serve 80 countries in Middle East and Africa from its Dubai Internet City hub; Has signed several deals with regio... Read more

New Board Certifies DMCC Tradeflow As Fully Shariah Compliant

Shariah Supervisory Board appointed to oversee Tradeflow’s Islamic finance offering; Certified fully-compliant with A... Read more