Trumps Return Sparks Crypto Surge: What Does This Mean For The US, Middle East?

One of Donald Trump’s many promises during his presidential campaign was to make the US the “crypto capital” of the world. His re-election as President has ushered in a new era for the cryptocurrency industry, marked by significant policy shifts and market reactions.

Trump’s administration has signalled a strong pro-crypto stance, with initiatives aimed at integrating digital assets into the US financial system. The development holds particular significance for the Middle East, a region increasingly involved in the global crypto landscape.

Upon returning to the office, Trump immediately implemented policies favourable to the cryptocurrency sector. One of his first actions was signing an executive order to establish a “working group on digital asset markets.”

This group is tasked with exploring the creation of a strategic national digital asset stockpile and developing a comprehensive regulatory framework for cryptocurrencies. The administration’s goal is to position the US to foster innovation and reducing regulatory uncertainties that have previously hindered the industry’s growth.

Bitcoin’s recent price action tells a compelling story of market sensitivity. After hitting a low of $92,000 following Trump’s announcement of massive tariff hikes on Canada, Mexico, and China, the flagship cryptocurrency rebounded sharply to cross $101,731, marking a 6.57 per cent increase. Ethereum demonstrated even greater resilience, surging over 14 per cent from $2,451 to $2,799.

“Though bitcoin has historically been viewed as a hedge against traditional market volatility, the heightened volatility in its prices is clearly an indication of the growing sensitivity of the flagship digital currency to global economic events amidst its rising mainstream acceptance,” Ryan Lee, Chief Analyst at Bitget Research, Arabian Business reported.

In line with this vision, Trump appointed David Sacks, a venture capitalist and early supporter, as the White House AI and cryptocurrency czar. Sacks, a venture capitalist and early cryptocurrency advocate, is expected to play a pivotal role in shaping policies that promote the adoption of digital assets and blockchain technology. His appointment reflects the administration’s commitment to integrating cryptocurrency into the broader economic framework.

Market reactions and economic implications

The market’s response to Trump’s re-election and subsequent pro-crypto policies has been swift and pronounced. Bitcoin, the flagship cryptocurrency, surged past $100,000 for the first time, reflecting investor optimism about a more supportive regulatory environment. This rally extended to other digital assets, with Ethereum and various altcoins experiencing significant gains.

On Wednesday, Trump-backed crypto platform World Liberty Financial announced a token reserve to boost cryptocurrencies including Bitcoin and Ethereum.

“World Liberty Financial (WLFI) is proud to unveil the Macro Strategy, our strategic token reserve designed to bolster leading projects like Bitcoin, Ethereum, and other cryptocurrencies that are at the forefront of reshaping global finance,” the announcement revealed via X.

Wall Street’s engagement with cryptocurrency has intensified, with Goldman Sachs and JPMorgan revising their cryptocurrency strategies to align with the new regulatory environment. The establishment of cryptocurrency ETFs and other investment vehicles has made digital assets more accessible to traditional investors, further driving market growth.

Analysts attribute this surge to expectations of deregulation and increased institutional adoption under the new administration. The establishment of a clear regulatory framework is anticipated to attract more institutional investors, further legitimising cryptocurrencies as an asset class. However, some experts caution that the rapid appreciation in crypto prices may also lead to increased market volatility and speculative behaviour.

Middle East and crypto

The Middle East has been actively engaging with the evolving crypto landscape, with countries like the UAE positioning themselves as leaders in blockchain innovation. The UAE’s proactive approach includes establishing regulatory frameworks that encourage the adoption of digital assets while ensuring compliance with international standards. This strategy has attracted numerous blockchain startups and significant investments in the region.

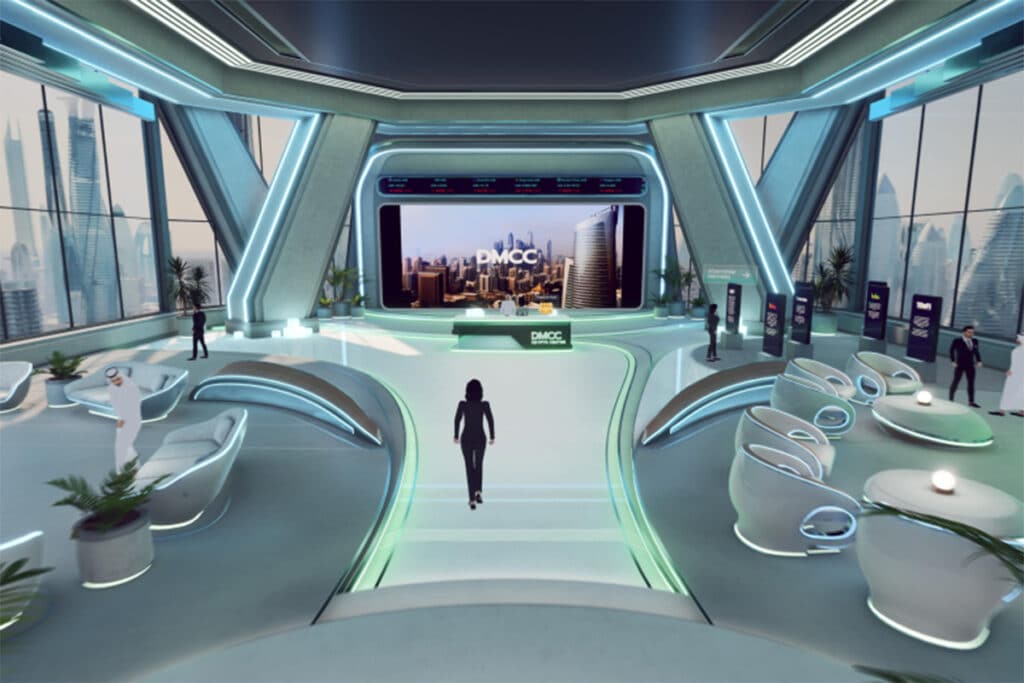

Dubai’s DMCC Crypto Centre has reported a 300 per cent increase in blockchain company registrations since Trump’s re-election, highlighting the region’s growing importance in the global crypto ecosystem.

Saudi Arabia has also accelerated its cryptocurrency plans, with the Saudi Central Bank (SAMA) announcing pilot programmes for central bank digital currencies (CBDCs) in partnership with US technology providers. These developments align with the kingdom’s Vision 2030 goals of economic diversification and technological advancement.

Eric Trump, the executive vice president of the Trump Organisation, has acknowledged the UAE’s leadership in the crypto space. Speaking at the Bitcoin MENA conference in Abu Dhabi, he praised the nation’s efforts in fostering a blockchain-friendly environment and highlighted potential areas of collaboration between the US and Middle Eastern countries in the digital finance sector.

Bahrain, another regional crypto hub, has strengthened its position by updating its cryptocurrency regulations to maintain compatibility with evolving US standards. The Central Bank of Bahrain has expanded its cryptocurrency licensing framework, attracting major international exchanges and service providers.

As the US under President Trump advances its pro-crypto agenda, the implications for the Middle East are multifaceted. Acording to experts, stakeholders must prioritise transparency, ethical considerations, and regulatory compliance.

UAE Announces Major New Tax Rules

UAE introduces Cabinet Decision to amend tax rules and attract investment Read more

UAEs Maseera Acquires Egyptian Fintech ADVA

The move marks a critical milestone in Maseera’s regional expansion strategy Read more

Oman Mandates IBAN For Domestic Transfers From July 2025

The move follows the Oman Central Bank's implementation of the IBAN system for international transfers from March 31, 2... Read more

Egypt And Jordan Thank The European Parliament For New Financial Aid

The European Union members recently approved loans worth $4.4 billion in three instalments to Egypt and $555 million to... Read more

Standard Chartereds SC Ventures To Replicate Asia, Africa SME Model In GCC

SC Ventures to bring its successful SME building strategy in India, South East Asia and Africa to GCC, and plans to rol... Read more

UAE Central Bank Revokes Licence Of Dynamics Insurance Brokers For Regulatory Breaches

Dynamics Insurance Brokers "failed to comply with the licensing terms and requirements issued by the Central Bank and w... Read more